During this period of inflation and turbulent markets, Wisconsin’s families may be afraid to invest. While neighborhood tricksters may try to give you a little fright this Halloween, saving for college doesn’t have to!

During this period of inflation and turbulent markets, Wisconsin’s families may be afraid to invest. While neighborhood tricksters may try to give you a little fright this Halloween, saving for college doesn’t have to!

Edvest, Wisconsin’s 529 College Savings Plan, is a highly rated, affordable, and tax-advantaged plan that has been helping families prepare for the cost of higher education for 25 years.

Saving for College Doesn’t Have to be Spooky

The cost of higher education may seem overwhelming, but achieving your savings goals is possible when you establish a plan.

The best place to start is by determining the amount of your child’s education you wish to fund. Is it covering the cost of their first semester, first year, or making sure they have enough to cover the technology they need? Once you establish your goal, you can build a savings strategy to help you get there. Time is your biggest asset when it comes to saving for larger costs, so the earlier you start, the better!

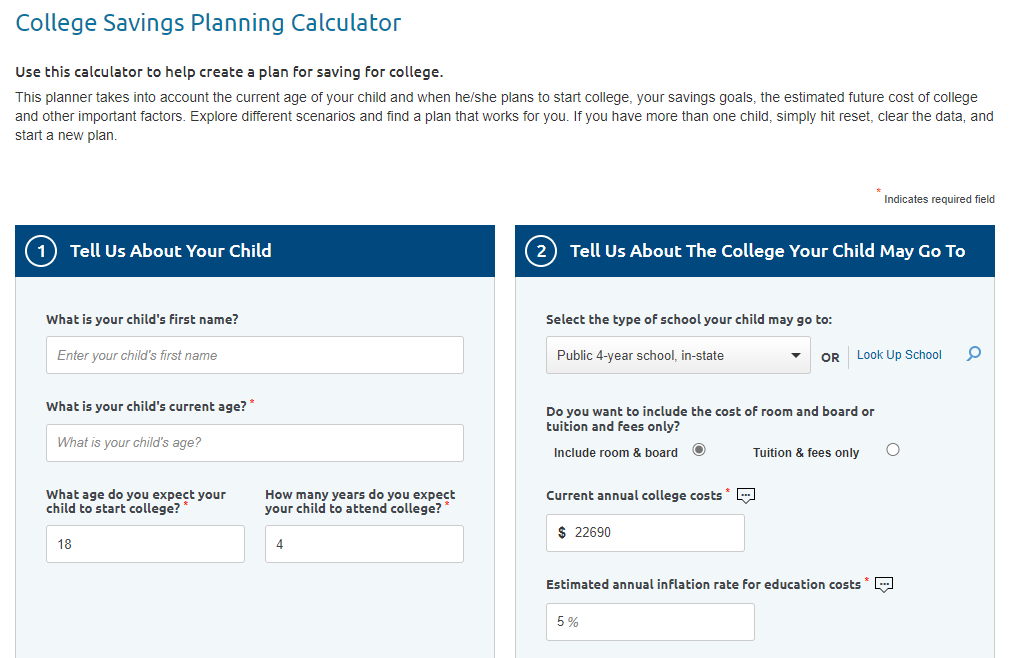

If you’re not sure where to start, try the Edvest College Savings Planning Calculator. This tool considers your child’s age, when they plan to start college, your overall savings goal, and the estimated future cost of college (along with other important factors) to provide you with a snapshot of how your savings will add up.

No matter your financial situation or savings goal, Edvest can help your family prepare. Opening an account takes about 15 minutes and you’ll experience several benefits, including:

No matter your financial situation or savings goal, Edvest can help your family prepare. Opening an account takes about 15 minutes and you’ll experience several benefits, including:

- No big upfront cost – open an account with just $25 and contribute through payroll direct deposit, through a checking or savings account, or via check.

- Low fees – Edvest is among the lowest cost 529 plans available.1

- Tax incentives – Wisconsin residents can claim a state tax deduction of up to $3,560 per account, plus earnings grow tax-deferred and qualified withdrawals are tax-free.

- Flexibility – use funds to pay for tuition, room and board, books, fees, and more at any accredited college, technical school, and apprenticeship program across the country.2

- Anyone can contribute – not just the account owner! Friends and family can give the gift of college for birthdays, holidays, or other special events like graduation.

Start Saving for Your Little Pumpkin’s Higher Education Today

To help families jumpstart their college savings, Edvest is announcing a $50 treat for new accounts opened between October 10 and October 31, 2022.

It’s easy for anyone to start saving for higher education and receive the Edvest bonus. Follow these four steps:

- Open an account between 10/10 and 10/31 at Edvest.com/treat

- Make an initial deposit of $50

- Set up recurring contributions of $30 or more for six consecutive months

- Receive the $50 bonus!*

The sooner families start saving for higher education, the more time their money can grow. And that can give them a stronger financial foundation down the road for their loved one.

For more information, visit Edvest.com or follow Edvest on Facebook.

1ISS Marketing Intelligence 529 College Savings Fee Analysis Q2 2022. Prior to the fee reduction, Edvest was the sixth lowest cost 529 college savings plan in the country. Edvest’s average annual asset-based fees were 0.16% for all portfolios compared to 0.52% for all 529 plans – more than three times lower than today’s national average for 529 plans.

2Withdrawals for registered apprenticeship programs can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances.

*When you open a new Edvest account with a $ 50 contribution (and sign up for recurring contributions of $ 30 or more per month for a minimum of 6 months) between October 10, 2022, at 12:01 a.m. (CT) and October 31, 2022, at 10:59 p.m. (CT), Edvest will match $50 on or before May 31, 2023. Visit www.Edvest.com/treat for terms and conditions. Void where prohibited or restricted by law. Promotion ends October 31, 2022. Sponsored by Wisconsin’s Edvest College Savings Plan.

To learn more about Wisconsin’s Edvest College Savings Plan, its investment objectives, tax benefits, risks and costs, please see the Plan Description at Edvest.com. Read it carefully. For the 2022 tax year, Wisconsin taxpayers can qualify for a state tax deduction up to $3,560 per beneficiary from contributions made into an Edvest College Savings Plan. Investments in the plan are neither insured nor guaranteed and there is the risk of investment loss. If the funds aren’t used for qualified higher education expenses, a federal 10% penalty tax on earnings (as well as federal and state income taxes) may apply. Check with your home state to learn if it offers tax or other benefits such as financial aid, scholarship funds or protection from creditors for investing in its own 529 plan. Consult your legal or tax professional for tax advice.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributor and underwriter for the Wisconsin’s Edvest College Savings Plan.

Admaster #2449823