Money knowledge is a skill that needs to be taught, and if parents aren’t putting in the time to educate their kids now, their children may find themselves looking for lessons a little too late (i.e. once they’re in debt in college). I’m not saying this to scare or guilt you, but rather to provide you with the tools and understanding to be able to employ some tactics at home to get started (or change courses) if you need!

Believe it or not, allowance can be a controversial topic when details are glazed over. Some parents and experts support a standard allowance that is given regardless of chores being done for the sole purpose of understanding how to save and handle money. Some parents and experts don’t agree on offering any allowance at all. Some parents and experts, like me, fall somewhere in the middle. I grew up in the finance field, and while I don’t consider myself an expert after being a stay-at-home mom for 5 years, I once was a Financial Advisor. Now, I’m married to a Financial Advisor and still the daughter to two Financial Advisors as well. (People joke about how riveting our family holidays must be). If you are a big Dave Ramsey fan, he also falls somewhere in the middle and just coins this method with a different name (Commission Allowance).

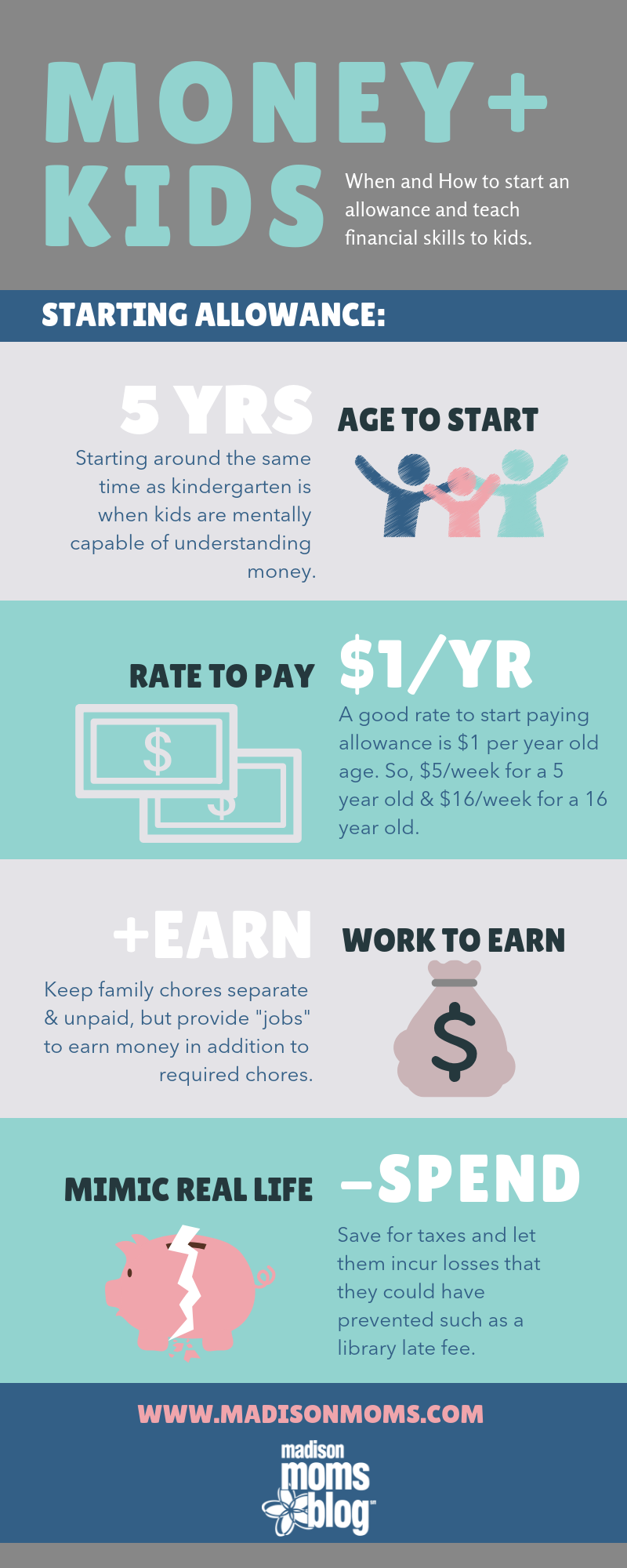

When to Start an Allowance

Allowance is an important teaching tool that can mimic adult life and let your children make financial mistakes without any actual real-life discourse. Starting young can help ingrain the idea that money is earned and encourage helping around the house. Some toddlers can begin simple chores by 3 or 4 years old such as picking up toys, making their beds, setting the table, etc. By the time your child is entering Kindergarten, they are ready to understand money.

How to Earn Allowance

Something for you to decide on is which chores are household chores and which chores are “extra”. Household chores are not paid and are something that each member of the family has to do in order to contribute to the home. For example, Dad can do dishes, Mom can take out the Trash, and the kids can make their beds and sweep the floors. “Extra” jobs are jobs that are non-essential to the household functioning, and they can be different amounts and even put on display on a cute “job board” if you feel like getting pinterest-y. This could be something like scrubbing the tub, raking leaves, “babysitting” your brother, or sorting clothing. Once a job is offered, you pay as soon as it is complete, and drive home the idea that they earned their money. At this young of an age, quality doesn’t matter as much as completing the task.

What to Pay for Allowance

There are multiple ways to approach the amount to pay for allowance. Some parents like to take these jobs and rate them according to hired help, such as $20 for mowing the lawn and $.50 for clearing the dinner table. A good rule of thumb to follow is $1 per year of age for your child. The amount that you pay doesn’t matter as much as the concept that the money was earned and is now theirs to manage.

How to Manage Allowance

Once your children have earned their allowance, they have to manage their money. This is your opportunity to talk with them about being smart with money and how to allocate savings, charity, taxes, and even an emergency fund. Having an open conversation about money early on will benefit everyone. Saving 50% of everything earned is an easy rule to implement and show that even though they earned their money, it’s important to save it. Once they have their 50% for spending and 50% for saving, you can divide the 50% saved to account for savings, taxes, charity, and emergency fund however you see fit. Another good idea to mimic real life is to allow them to cover their own mistakes. Did they get a late fee at the library? That’s what their money is for. They’ll begin to establish a sense of responsibility and independence well before they enter their own credit history and will have a sense of ownership over their belongings when they’re financially responsible for them. (That doesn’t mean that parents shouldn’t ever gift a surprise toy or treat ???? ).